Until recently, most wealth management companies didn’t know any other business models except human interactions. But now, the industry is on the verge of major disruption.

In the past several years, asset and wealth managers have been closely watching what FinTech companies were doing. One of the reasons is that their clients are asking for greater flexibility and convenience they are enjoying in eCommerce and social media.

Digital transformation is the most promising strategy to make that happen. The fear of losing clients due to more innovative counterparts, wealth management companies are actively building their digital capabilities.

Wealth Management: the Traditional Model vs. FinTech

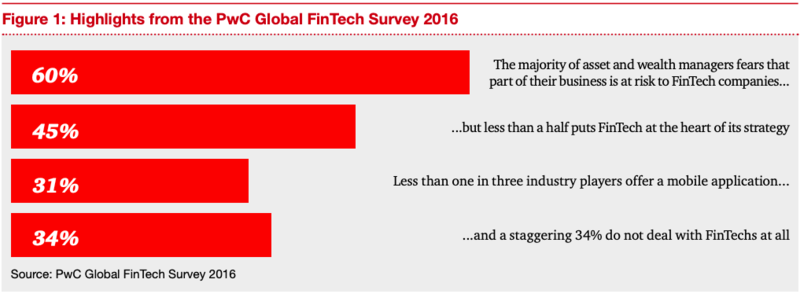

Back in 2016, PwC conducted a survey of asset and wealth managers, asking about their concerns and opinions about budding FinTech solutions. As many as 60 percent of the surveyed said they feared losing a part of their businesses to FinTech companies.

Source: PwC

As you can see, the majority of firms were still reluctant to abolish the traditional model based on personal relationships. Only 31 percent, for example, invested in app development to allow clients to conduct financial operations online.

Then, digital transformation became a thing in the financial industry. It’s the operational, organizational, and cultural change of a company driven by the use of technology.

Using technology such as apps to deliver better customer experience was a major breakthrough. Those who invested in mobile banking apps have been hugely successful, so by 2018, 86 percent of U.S. banks offered mobile payments to customers.

The financial motives were also becoming less important, as more people appreciated the possibility of managing their finances easier and faster.

But there are other reasons why digital transformation is a must for wealth management companies now. Let’s take a look at all of them next.

-

Improve the Overall Customer Experience

Even though processes in a wealth management firm may look organized and efficient to clients, the reality is often different. Due to a paper-based environment and the need to meet with clients to discuss major decisions, the operational efficiency is low while the costs run high.

This often results in poor customer experience.

Digital transformation can change that.

For example, by going from paper to digital, you can greatly speed up processes and be available for your clients 24/7. To eliminate the inefficiencies of paper-based documentation, companies use identification verification, electronic signature, and document scanning.

They also create online customer banking profiles, knowledge bases, investment guides, and other resources on their websites. This helps clients with using the services and monitoring their investments.

mBank’s Asset Management program. Source: screenshot

So, using technology to take wealth and asset management features online is something that enhances customer experience. And it makes sense: who not digitize the functions that you can do online?

Keep in mind, however, that digitizing wealth management services requires quality web development. The security and understanding of the financial industry are important to create a service that people would want to use.

-

Help Clients Seize Investment Opportunities

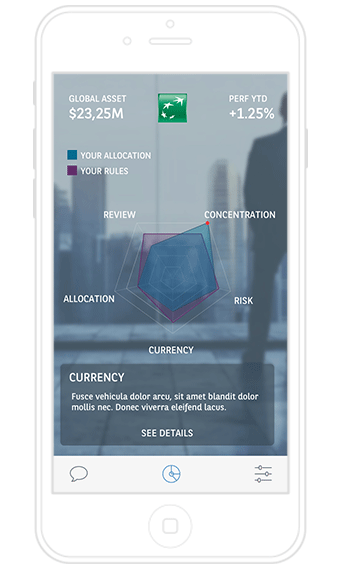

Besides standard features like portfolio overview and tools for portfolio personalization, banking apps can also help users stay updated on the latest investment opportunities.

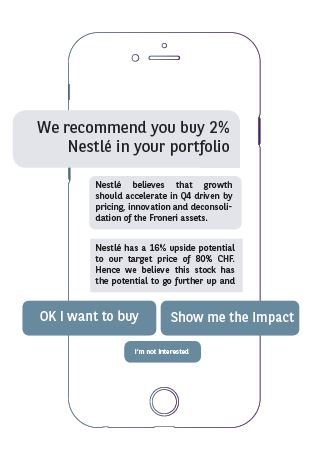

Let’s take BNP Paribas’s MyAdvisory tool as an example.

It comes as a part of the official app of BNP. At the time of its introduction in 2017, it was the world’s first mobile investment advisory tool, and it still remains one of the best.

Source: BNP Paribas

Here’s how the app helps users make better investment decisions and seize opportunities to invest. It:

- provides personalized financial advice. Videos, articles, graphs are created and curated by a dedicated advisory team for each user

- shares investment trends and ideas. The feed with this information is updated regularly and provides content based on the user’s portfolio

- allows them to buy, sell, and hold their wealth. The built-in myChat&Trade platform enables users to purchase and sell on all markets, get online notifications of personalized trade opportunities, and even receive a consultation from an investment specialist in real-time via live chat.

Important! The development of a wealth management app like that requires features your current app might not have. They include built-in message service for investment updates, live chat or chatbot for communication with advisors, and portfolio management tools.

That’s why this project needs a dedicated team of developers. They will be working with your financial experts to create solutions that will help users to capitalize on investment opportunities.

Related: Why Your Business Needs a Mobile App in 2020.

-

Stay Competitive

With more and more companies investing in wealth management app and website development, the market is already highly competitive. To keep up with the competition and stand out from the crowd, your company needs to undertake a complete digital transformation.

In fact, you can be better than many competitors who are already using this strategy.

Here are the common mistakes that financial organizations make (and you need to avoid to outcompete them):

- Designing super complex apps and user interfaces. Managing wealth and assets can be a difficult task, especially if the app you’ve chosen is hard to use. By providing easy and simple navigation and limiting features to the most impacting ones, your digital wealth management products’ ratings can go up fast

- Failing to ensure complete security. Just one security flaw can be a disaster, especially when it costs your customers. It happens much more often than you think: the latest data says that most of the American top banking apps have serious security flaws.

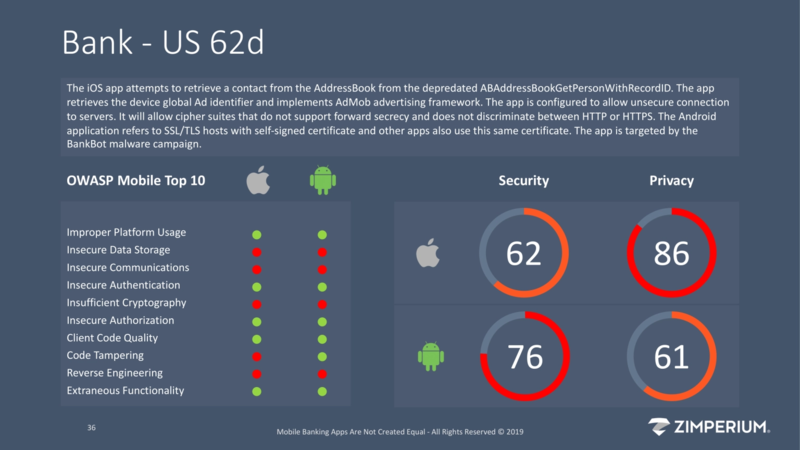

Here’s an analysis of issues of an unnamed popular banking app that scored 86 out of 100 on the security scale.

- Not providing instant support features. All digital banking products you design must come with the fastest customer service features, such as live chat and chatbots. A lack of these might result in more disappointment than a delight, especially if it costs a client an investment opportunity

- Not treating digital transformation as a comprehensive strategy. Digital transformation is not only about technology. It’s also the organizational and cultural change that requires all employees to perform their duties in a new way (and forget the traditional practices once and for all).

We really can’t stress enough how important it is to avoid these critical mistakes. Be sure to choose quality web development services to ensure that they don’t stand in the way of your success.

-

Sell More Additional Financial Products

People who love using digital products for wealth management are likely to use your services more. This is the finding described in this recent article of ABA Banking Magazine.

Accordingly, Millennial users who rated their wealth management app experience as “outstanding” were more likely to sign for additional services. Moreover, user satisfaction was also directly associated with the perception that the app was secure.

So, by creating easy-to-use, helpful, and secure digital wealth management products, you can also increase your sales of other financial products.

Conclusion

It’s time for major changes in the wealth management industry. At this very moment, quietly, companies are working on creating online platforms, apps, and other digital tools to help clients do financial operations online.

To avoid being outcompeted, consider investing in digital wealth and asset management solutions and tools. Not only it’ll be a great business decision, but also a great way to improve your client experience that allows them to get nice investment returns thanks to your tools.